The goal of financial inclusion is to promote socio and economic development by helping unbanked population. It provides them access to basic financial services and formal means to spend, receive and save money. Mobile Money is being used as an effective tool for the same in many countries.

There are two ways to use mobile money –

(1) OTC (Over the Counter) – Customers visits a mobile money agent and the agent performs the transaction on behalf of the customer

(2) Direct ( Self ) Initiated – Customer can directly perform transactions using mobile phone. For this customer will have to get registered first and deposit the money into wallet.

The financial inclusion is achieved in both aspects though the ultimate goal of the financial inclusion ( and financial literacy ) is that the people should have wallets and they should be able to perform basic financial transactions by themselves.

A mobile money eco system has many components/actors who participate and benefits from it (financially or by other means ) –

- Mobile Money Provider – Telco or Bank or Consortium

- Mobile Money Distribution Network – Mobile Money Agents spread strategically throughout the country

- Mobile Money Partners – Utility Biller Enterprises, MFIs, Banks etc

- Mobile Money Customers – Who use mobile money either directly or by visiting mobile money agents

Within this mobile money eco system the emoney is pushed to everyone from the top ( Mobile Money Provider). The physical currency to emoney or emoney to physical currency conversion happens between these components/actors depending on the transaction type.

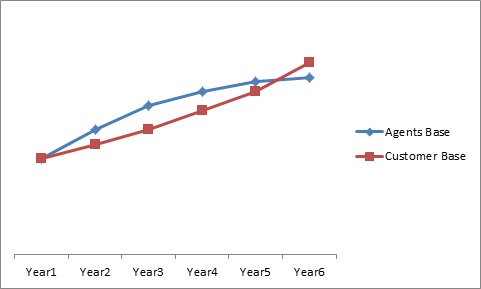

The distribution network helps mobile money provider to serve and reach the low income people and it helps to grow and manage the mobile money business. A mobile money business can’t be setup/sustain without a healthy distribution network.

Direct customers are always an advantage for the MM provider as it doesn’t need to give any commission to the agents when these customers are directly performing the transactions using their wallets. Having said that these customers still need to visit the agents for the deposits and withdrawals.

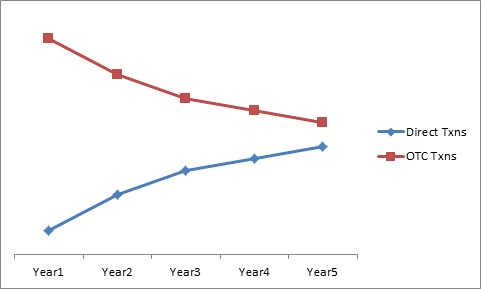

So there is always a balance achieved within the mobile money eco system where you have OTC transactions as well direct customers initiated transactions. It takes time to gain customers confidence and to increase awareness, hence OTC is always dominating in first few years and wallets are significantly lower. The distribution network keeps growing to serve more and slowly the growth rate gets saturated.

A typical progression of Direct Txns and OTC Txns may look like this –

The growth of the agent’s network ( in 100s) and customer base ( in 1000s ) may look like somewhat similar to below

Some facts relevant to the OTC transactions –

- OTC is more dominant in Country Side/ Rural area for the obvious reasons e.g. less education, less financial literacy etc. Hence it is important to have a good and wider agent’s network in country side.

- Traditional models of competing businesses e.g. Bill Pay or Money Transfer agencies works on OTC model and hence to start with people will often compare mobile money with them. They will be more comfortable with performing OTC transactions.

- Even if it’s not a push from MM provider, if the design is done in such a way that it provides distinct advantage to people of directly using it, there is no reason why would not customers move from OTC to Self-initiated mode.

- For mobile money business, OTC transactions are the backbone. Simple fact is even if you get customers on board registered, what you can do with them if they don’t have means of Deposit which is again an OTC txn.

- The flaws/issues related to OTC (such as agents frauds or agents charging more) needs to be corrected in any case, getting customers on board registered is not going to solve those problems.

OTC is an EVIL?

When we compare OTC Vs Wallet Txns , there is no deny that customers having wallet is a win-win situation for both customers and MM providers. Also it is the ultimate goal of financial inclusion and financial literacy. Having customer’s wallet makes the base where one could avail micro financial services.

We do see MM providers struggling to get customers on board and push the direct transactions. But we need to remember that it is not OTC which is responsible for people not having wallets. There are various reasons because of which the % of Wallet Txns is less compare to OTC. For example there could be registration barriers such as complicated registration requirements, lack of financial education, no KYC availability with some people, reluctance to put extra money in the wallet, other behavioural aspects etc.

Agent’s network is an integral part of MM eco system. MM providers are able to reach to millions of customers through this agent network. A healthy agent network is required for a successful mobile money business. There could be issues related to agent network which needs to dealt accordingly. Hypothetically even if we imagine a mobile money eco system with 100% direct customer transactions, Agents will still be required for deposit/withdrawals.

We also need to consider the fact that the mobile money distribution network is part of the MSME and it is overall good for the country/economy to have a good growth for MSME sector.

To address the issue of less customers on board (i.e. less wallets) requires customer centric approach and steps such as increasing customer education/awareness, more importantly creating a value proposition which motivates customers to get registered, registration campaigns, promotions, more and more bulk payments (be it G2P or Salaries etc.), micro financial services products, specific use cases such as utility bill payments etc.

This may not necessarily means to go against Agents/OTC but parallel efforts towards gaining more customers while maintaining the existing healthy agent network.

All the deployments MPesa or EasyPaisa or bKash, have mostly started with OTC model and they have successfully progressed from there.

In case of EasyPaisa which was launched in 2009, serves 7.4 million unique users. Of these customers, 2.4 million are direct wallet users and another 5 million are OTC customers. On the question of OTC Vs Wallet Txns, according to the management of easypaisa ( Quoted from cgap article ) – “If given the advantage of hindsight, I still would have launched the business with OTC as the leading service. It takes time to create the confidence in a customer to start using an agent as a bank branch. When EasyPaisa started, there was no wider market awareness of mobile payments – we had to introduce the concept and build trust. We have also built up a large agent network on OTC volumes reaching some 30,000 points of service across Pakistan that are spreading awareness of the EasyPaisa brand. OTC is a permanent part of our business and is there to stay. But it is critical that the wider ecosystem evolves providing a setting where the e-wallet business can thrive.”

It is important to understand the demographics and have a separate strategy for OTC and a separate strategy for direct customer acquisition. The push, focus and efforts should be driving m-wallet transactions without being compromised on OTC part.